Listen to the article – Empowering Europe: Unveiling Opportunities and Challenges in EU’s Semiconductor Industry

Semiconductors represent a significant force for economic prosperity and are becoming a national security issue.

Trade disputes and the COVID-19 pandemic led to the disruption of the globalized supply chain ecosystem and highlighted the potential ramifications to the semiconductor supply chain. In addition, the current conflicts in Eastern Europe and the Middle East and the combined economic aftereffects intensified the disruption adding a technological sovereignty dilemma into the equation. These events prompted governments and technological corporations around the world to seek avenues that would reduce the dependency on third-party semiconductor suppliers and localize and/or rather regionalize the semiconductor manufacturing processes.

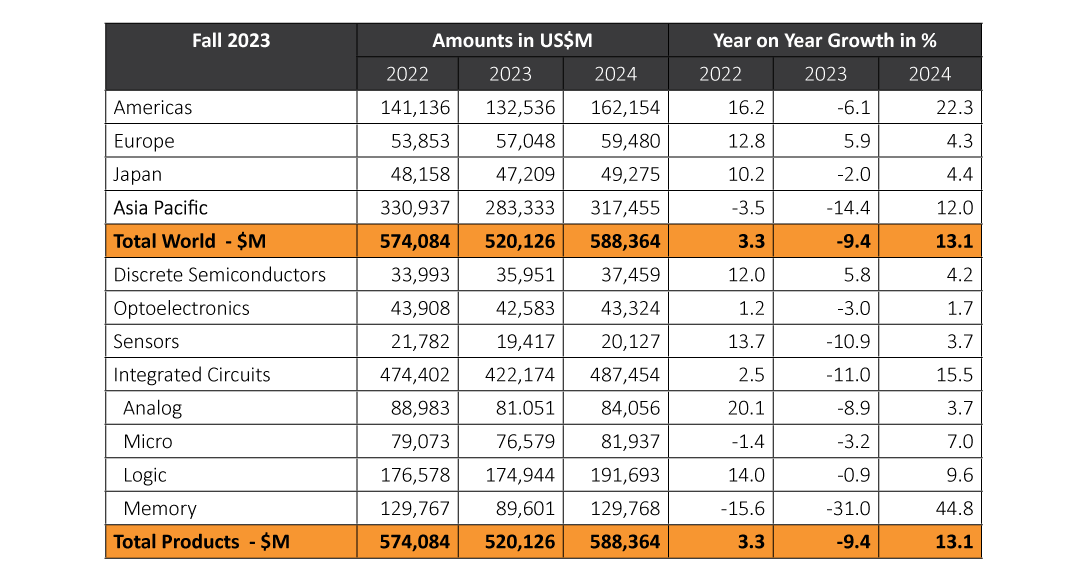

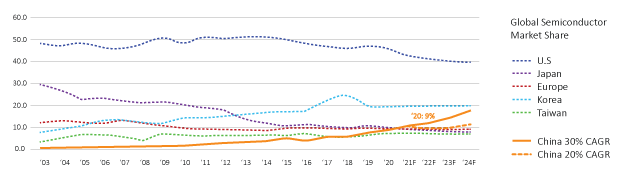

Even though the world is currently witnessing an accelerated growth of the semiconductor industry, according to the World Semiconductor Trade Statistics, the global market in 2023 faced a downturn. Nevertheless, statistics show that the global semiconductor market is anticipated to rebound strongly in 2024, with a projected growth of 13.1 percent, reaching a total value of USD 588 billion. The EU area is also poised to witness sustained expansion in 2024, with year-on-year growth of 4.3 percent[1]. (Fig.1)

Figure 1. WSTS Forecast Summary

Furthermore, EU’s endorsement of the IPCEI ME/CT program in June 2023, allocating over EUR 8 billion in grants to semiconductor industry projects, followed by the adoption of the CHIPS Act in September 2023, underscores the Union’s dedication to supporting such projects, laying out the conditions for growth of EU semiconductor industrial base, aiming to mitigate future potential fluctuations related to the semiconductor shortage. The Act seeks to stimulate European semiconductor development and manufacturing, reflecting a concerted push to diminish reliance on third-party semiconductor manufacturers. While concerns about the feasibility of this endeavor have been raised,[2] the initial investment of EUR 43 billion is expected to have several positive effects, paving the way for advancements in crucial sectors such as 5G networks, autonomous driving, artificial intelligence, and quantum computing. Lastly, the above chain of events led to the inauguration of the Chips Joint Undertaking[3] in November 2023, designed to strengthen EU’s technological leadership as well as its semiconductor ecosystem.[4]

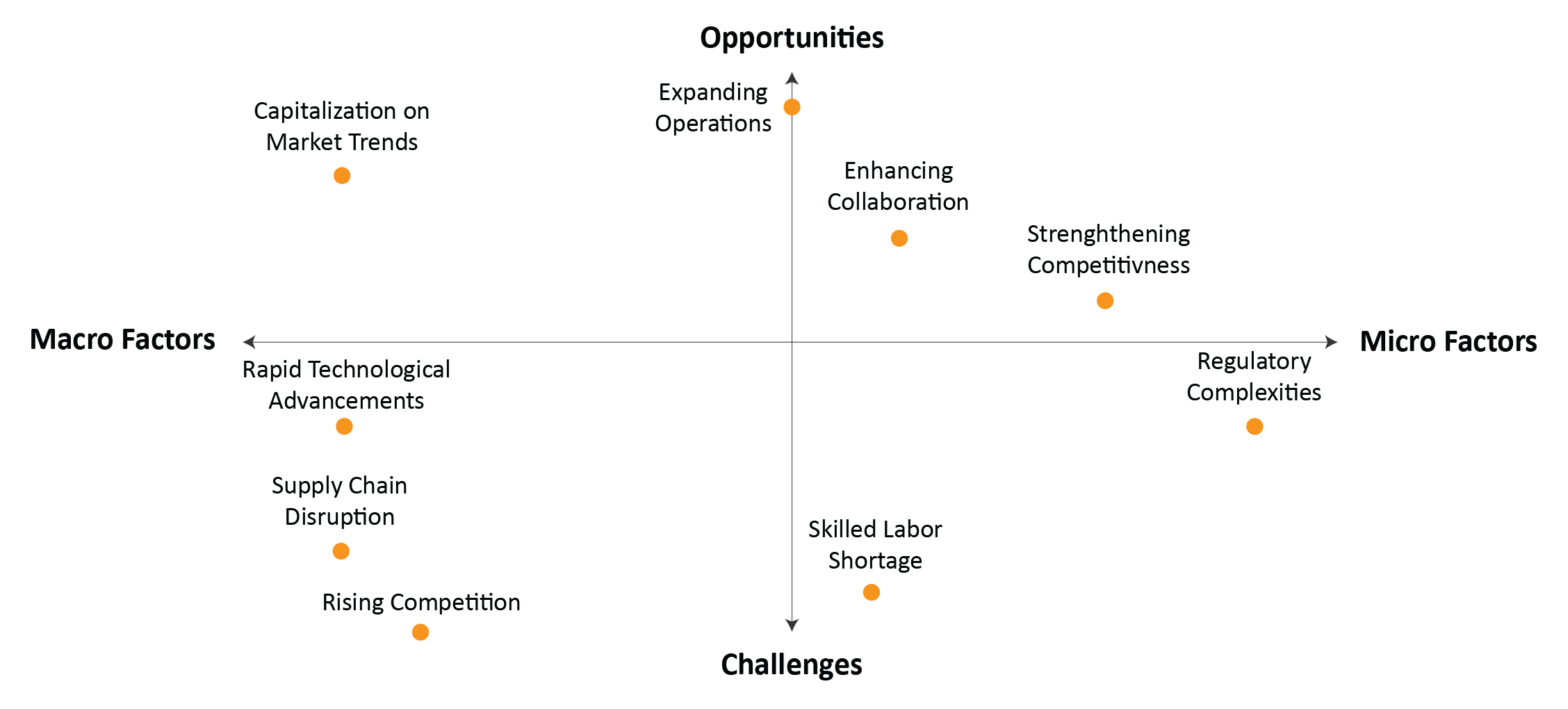

In this context, the commentary explains the mission of the initiative Chips Joint Undertaking (CHIPS JU), and in consideration of micro and macro environmental factors analyzes the opportunities and challenges for companies aiming to invest in EU’s semiconductor landscape. The last part provides strategic imperatives on how companies can leverage these factors and utilize investments effectively.

01

The Mission of CHIPS JU

01

The Mission

of CHIPS JU

The EU’s CHIPS JU initiative signifies a strategic endeavor to fortify Europe’s position in the global semiconductor landscape.

It aims to address the semiconductor shortage within the Union, reduce dependency on external actors, and double the EU’s semiconductor production share by 2030, which currently stands at around ten percent, thus advancing Europe’s technological sovereignty, competitiveness, and resilience.[5] (Fig.2)

Figure 2. Global Semiconductor market Share by Major Country

To achieve these objectives, the CHIPS JU initiative focuses on several key areas. Firstly, it supports research and development efforts to establish robust design and manufacturing capabilities while facilitating technology transfer to industrial settings. Secondly, it aims to foster a dynamic ecosystem for digital value chains and enhance critical infrastructures. Additionally, the initiative seeks to coordinate national and Union research programs, align with strategic agendas and policies, and build advanced semiconductor development capacities, including quantum semiconductors. Furthermore, CHIPS JU endeavors to establish competence centers across Europe to promote collaboration and knowledge sharing in semiconductor technology. Lastly, the initiative aims to address the requirements of sectors such as transportation, healthcare, communication, and manufacturing, catering not only to semiconductor manufacturers but also to end-user industries.[6] That said, following parts analyze macro and micro effects on opportunities and challenges regarding EU semiconductor industry. (Fig 3.)

Figure 3. Macro Factors / Micro Factors / Opportunities / Challenges

02

Opportunities for EU Semiconductor Companies

02

Opportunities for EU Semiconductor Companies

The initiative will likely offer semiconductor companies a unique opportunity to strengthen their competitiveness, capitalize on emerging technology and markets, enhance collaboration opportunities, and expand their operations, positioning themselves for sustained growth and innovation in the dynamic global semiconductor landscape

Strengthening the competitiveness of EU companies in the global semiconductor market by fostering innovation, research, and development, is evident from the recent EU’s announcement for injecting EUR 216 million to support R&D initiatives related to semiconductors.[7] In addition, the EU is advocating for leading players like TSMC and Samsung to establish advanced manufacturing facilities within Europe, to bolster its competitiveness in technology and science.[8]

On the other hand, EU recently granted access to significant EUR 1.3 billion fund from Horizon Europe[9] to the UK for semiconductor research until 2027, integrating it as a participating state in the CHIPS JU initiative.[10]

Moreover, the INFRACHIP project endorsed by the EU is aiming to accelerate research and development and establish a European research platform for sustainable development of next-generation semiconductor chips. These development trends influenced by micro-level factors will further enable companies to stay at the forefront of technological advancements, driving product innovation and diversity and will likely provide opportunities in the EU market to strengthen their competitiveness and foster R&D initiatives in the EU semiconductor industry.

Download Report

Empowering Europe: Unveiling Opportunities and Challenges in EU’s Semiconductor Industry

Semiconductors represent a significant force for economic prosperity and are becoming a national security issue.

Capitalization on emerging technologies and market trends, such as AI-driven chip design, quantum computing, and sustainable semiconductor manufacturing is another opportunity, dependent on macro environment, for semiconductor companies aiming to invest in the EU semiconductor industry. Given the UK government’s investment of GBP 22 million into semiconductor research hubs and the unveiling of its GBP one billion National Semiconductor Strategy,[11] there exists a notable opportunity for EU companies to capitalize on these developments. With the UK’s focus on intellectual property, design, and research and development within the semiconductor sector, it is likely that EU companies will forge strategic partnerships or collaborations with UK entities. Important to mention is France’s ambitious endeavor to bolster its capabilities in quantum computing for defense applications. France’s defense-procurement agency recently awarded contracts to five French quantum computer-research startups, with the aim of developing two universal quantum computer prototypes by 2032, backed by an investment of up to EUR 500 million.[12] The current market trend provides opportunities that could enable companies to leverage expertise in areas such as advanced manufacturing and supply chain management, contribute to the development and commercialization of advanced semiconductor technologies, therefore capitalizing on emerging market opportunities.

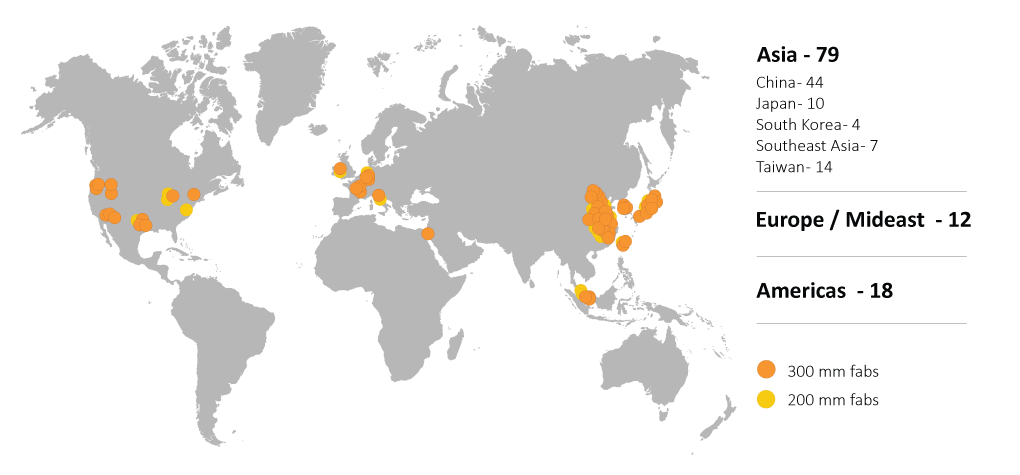

Enhancing collaboration among stakeholders poses additional opportunities within EU’s semiconductor ecosystem. Joint research projects, technology exchange programs, and collaborative initiatives facilitated by EU investment will enable companies to leverage expertise and resources from across the continent, fostering a culture of innovation and knowledge sharing. Such trend is evident with the collaboration among the Dutch-based NXP Semiconductors, the German-based Bosch and Infineon and the Taiwanese TSMC related to the establishment of the first European semiconductor manufacturing facility in Dresden.[13] Likewise, following the failure of the French administration to attract Intel’s operations to France, other technological companies stepped up to establish a new high-volume semiconductor manufacturing facility in Crolles, France.[14] GlobalFoundries Inc. and STMicroelectronics’ joint venture not only signifies a significant investment in Europe’s semiconductor ecosystem but also exemplifies the potential for enhanced collaboration within the industry. Italy also joined this trend recently, when the Italian Ministry of Enterprises announced an investment of EUR 3.2 billion by the Singaporean Silicon Box, which is set to establish a new fab in Italy.[15] Lastly, UK’s integration in the CHIPS JU opens possibilities for collaboration with Republic of Korea through a new funding opportunity aimed at enhancing semiconductor performance via advanced packaging. Therefore, by fostering and enhancing collaboration with local research institutions, government agencies, and industry partners, companies can harness synergies, access specialized knowledge, and accelerate innovation within the EU semiconductor ecosystem at a micro level. (Fig.4)

Figure 4. SEMI World Fab Forecast / Source: SEMI World Fab Forecast 4Q23 (Dec. 2023)

Expanding operations influenced by macro factors and has an impact on the micro environment, with establishing advanced manufacturing facilities, pilot lines, and competence centers will likely create a conducive micro-level environment for semiconductor companies, attracting talent, and further support local economic development. The most likely winner of such expansion would likely be Germany, as the Taiwanese TSMC is looking to establish its first production facility in Dresden by 2027, a joint investment worth EUR 10 billion.[16] In addition, Intel is already in the German city Magdeburg where the technological giant is involved in expanding its manufacturing capabilities with an investment of over EUR 30 billion.[17] Besides, the US tech giant is also involved in construction of an advanced assembly and testing facility in the Polish city of Wroclaw, with an investment of nearly EUR 4.3 billion, which is expected to positively influence EU’s labor market, particularly the IT sector, logistics and construction.[18] More recently, Intel announced its intentions to secure a minimum of USD two billion in equity to support the financing of a semiconductor manufacturing facility in Ireland. Hence, expanding operations in EU’s semiconductor ecosystem would allow companies to leverage local resources and market proximity to optimize production and distribution channels.

In summary, the initiative presents a promising prospect for semiconductor companies to bolster their competitive edge, leverage burgeoning technologies and markets, foster collaboration, and broaden their footprint. Such actions would strategically position these companies to thrive and innovate within the ever-evolving global semiconductor ecosystem.

03

Challenges Ahead for EU Companies

03

Challenges Ahead for EU Companies

In the rising competitive landscape of the EU semiconductor market, companies face formidable challenges stemming from rapid technological advancements, rising competition, supply chain vulnerabilities, regulatory complexities, and shortages of skilled labor.

Rapid technological advancements affected by macro environmental factor of the ever-growing digitalized world, which is closely intertwined with the semiconductor industry. Technological advancements, particularly in emerging fields such as AI, IoT, quantum technology and 5G connectivity, have accelerated the demand for more advanced semiconductor products, requiring cutting-edge semiconductor components.[19]

One of the primary challenges is keeping up with the demands for increasingly complex and sophisticated semiconductors. As modern technologies emerge frequently, existing products are being rendered as outdated in a short span of time, indicating the need for continuous investment in R&D to develop cutting-edge semiconductor designs and manufacturing processes. Therefore, those companies which aim to stay abreast of these trends to maintain competitiveness, will need to embark on coordinated efforts involving policymakers, industry stakeholders, as well as academic institutions.

However, securing sufficient funding and resources for such endeavors could pose challenges, potentially hindering the companies’ ability to innovate and compete effectively.

Rising competition is another macro-level challenge within the semiconductor industry marked with emerging market players, besides the already established “heavy weights” in Asia like TSMC and Samsung, or ASML in Europe, and Intel, Broadcom, Qualcomm, and NVidia. Such a trend will likely trigger or rather accelerate the overdue fourth industrial revolution. The expansion of major global players into Europe either through investments or establishment of new facilities, poses a threat to the EU semiconductor market. Furthermore, investing in cutting-edge semiconductor manufacturing, such as producing 4-nanometer semiconductors or below, may not be a viable strategy due to insufficient subsidies and the rising competition.[20] EU companies aiming to establish a foothold in this competitive landscape must contend with the technological prowess and significant market share of these industry giants. Breaking into the market requires substantial investment in research, development, and manufacturing infrastructure to remain competitive.

Supply chain vulnerabilities also present significant challenges for EU semiconductors industry, dependent on macro environmental factors. As noted in the previous analysis,[21] the current geographical concentration of major manufacturers of advanced semiconductors is mainly located in South East Asia. In fact, Taiwan covers 90 percent of the global demand for high-end semiconductors and accounts for 65 percent of the global demand of semiconductors, which uncovers the industry’s susceptibility to disruption of the global supply chain. Given the nature of the overall semiconductor ecosystem being globalized and dependent on technology from various parts of the world, events of geopolitical magnitude can cause global supply chain bottle-necks and disrupt the semiconductor industry, affecting the European market also. This is exemplified by the events in the Red Sea, where Yemen demonstrated its potential to disrupt the global supply chain and cause fluctuations in the world economy, triggering a shift in the semiconductor industry as well. Therefore, considering investments in EU semiconductor industry, companies must mitigate supply chain vulnerabilities posed by black swan events to maintain and advance operations.

Regulatory complexities present another challenge influenced from national and supranational policies and regulations within EU that further complicate investment decisions. Companies interested in investing in EU’s semiconductor sector must comply with stringent EU export controls, navigate investment screening processes, and contend with varying regulations across EU member states. As Europe grapples with reducing its dependency on foreign telecommunications infrastructure and electric vehicles, the European Commission has proposed measures aimed at safeguarding strategic industries, including semiconductors. However, the EU’s regulatory approach is cautious, influenced by its complex governance structure and the need to balance economic interests with national security concerns. The decentralized nature of decision-making within the EU means that member states retain responsibility for national security measures.[22]

With that being said, the European Commission’s deliberations on stricter measures to bolster economic security[23] places investors at the intersection of national security imperatives and global competitiveness. In this difficult regulatory environment, pressure from the US to curtail exports of critical technologies to China[24] further complicates matters, as European policies often align with US interests. Responding to EU’s redefined approach to economic security, the industry association SEMI Europe offers a cautionary stance, advocating for judicious application of export controls to prevent disruption of the semiconductor supply chain. Moreover, SEMI Europe raises concerns about the potential adverse effects of excessive screening mechanisms for foreign investments, warning of the possible deterrence of much-needed capital influx into EU semiconductor companies.[25]

Such complex regulatory landscape presents challenges for investors and policymakers, as efforts to protect Europe’s semiconductor industry must navigate a labyrinth of national and supranational regulations alongside national security issues. These regulatory challenges, hurdles and divergent national interests within the EU add layers of complexity to investment strategies, necessitating careful navigation of multiple and evolving regulatory frameworks.

The shortage of skilled labor, influenced by micro environmental factors, poses another challenge to the EU’s semiconductor strategy as manufacturers race to establish new production facilities across the continent. Despite the EU’s success in attracting major players like Intel and TSMC through subsidies and political support, the lack of adequately trained workers threatens to hinder the realization of these ambitious plans. Drawing parallels with experiences in the United States, where delays in plant openings occurred due to skilled worker shortages, the urgency of addressing this issue becomes apparent in the EU as well. In regions such as Sachsen-Anhalt in Germany, proactive measures are underway to mitigate potential labor shortfalls, with investments in education and vocational training initiatives.[26] However, fierce competition for talent, both domestically and globally, underscores the magnitude of the challenge.

Furthermore, the establishment of initiatives like the European Chips Skills Academy[27] demonstrates a collective response to the industry’s demand for skilled workers, yet policymakers face the imperative of swift action to ensure the sustainability of Europe’s semiconductor ecosystem amidst projections of significant industry growth. Noteworthy mention is that Netherlands faces significant challenges related to skilled labor shortages within its semiconductor industry, exemplified by the concerns surrounding the Dutch technological corporation ASML. With ASML contemplating potential expansion abroad due to staffing issues and perceived obstacles in public policy, such as reductions in taxes for foreign workers and limitations on highly skilled migrant intake, the country and EU as a matter of fact, risks losing a vital player in its semiconductor ecosystem.[28] ASML’s predicament underscores broader concerns about the Dutch business climate, indicating dissatisfaction among company executives regarding government stability, staff shortages, and tax policies. Moreover, the reliance on foreign talent within ASML, with 40 percent of its workforce originating from abroad, highlights the acute nature of the skilled labor shortage in the Netherlands’ semiconductor sector, that not only threatens the competitiveness of established industry players like ASML, but also jeopardizes the growth prospects of the broader semiconductor industry and its ability to attract and retain talent in the face of increasing global competition. Therefore, addressing the skilled labor shortage will enable companies to maintain growth in the dynamic semiconductor industry.

To sum up, in the increasingly competitive environment of the European Union’s semiconductor sector, enterprises confront substantial hurdles arising from swift technological progress, heightened competition, vulnerabilities within supply chains, intricate regulatory frameworks, and shortages in skilled workforce.

04

Strategic Imperatives for Semiconductor Companies in Europe

04

Strategic Imperatives for Semiconductor Companies in Europe

The EU semiconductor industry stands at the threshold of a transformative era marked by the integration of artificial intelligence into industrial production, indicating a digitalization of the manufacturing processes and leading to revolutionization of the methods of how companies operate.

EU investments in the semiconductor industry appear optimistic, presents opportunities and challenges for EU companies, propelled by legislative backing, substantial financial commitments, and cooperative ventures aimed at fostering innovation and fortifying the region’s standing in the global semiconductor market. By prioritizing innovation, collaboration, talent development, and strategic planning, companies can position themselves for success and contribute to Europe’s leadership in the global semiconductor market.

EU’s strong emphasis on R&D initiatives presents opportunities for semiconductor companies to lead in cutting-edge technologies. Investments in areas such as artificial intelligence, internet of things, and automotive electronics will likely position EU companies at the forefront of industry advancements. Overcoming the technological gap and bolstering competitiveness will necessitate sustained investments, robust R&D endeavors, and effective collaboration among public and private stakeholders. Therefore, companies should prioritize innovation and R&D investment to drive product differentiation and technological advancements as these can help drive growth and market differentiation.

Equally important, companies must assess and mitigate risks associated with supply chain disruptions, including geopolitical tensions, natural disasters, and trade disputes, since these prove to be crucial for strengthening of the globalized semiconductor ecosystem, enhance technological sovereignty, and remain competitive globally. Therefore, seeking avenues for regionalization of operations in various parts of Europe will likely prove to be sustainable over the mid-term.

Additionally, companies should further focus on building strategic partnerships and cooperative ventures within the semiconductor landscape. Collaboration and partnerships with industry peers, government agencies, research institutions, and other stakeholders facilitate knowledge sharing, resource pooling, and collective action to address challenges and seize growth opportunities in the current unstable geopolitical environment.

However, having more job openings than skilled professionals, which currently describes the current standing of the semiconductor industry, means that companies should prioritize talent development, skills enhancement, and retention to ensure a skilled workforce capable of driving innovation and growth in the semiconductor industry. Addressing the talent shortage should be a top priority for companies planning to enter and operate in the semiconductor market. Collaborative initiatives with educational institutions, government agencies, and industry associations can help cultivate a skilled workforce and mitigate talent risks, and investing in training programs, talent acquisition, and workforce development initiatives is seen as essential for building a sustainable talent pipeline and addressing skills gaps.

Lastly, companies should adopt a forward-thinking approach to regulatory compliance, intellectual property protection, and risk management, particularly in the EU, due to its complex governance structure. Proactively addressing regulatory requirements, protecting intellectual property assets, and implementing robust risk management strategies will be critical for mitigating the complex operating environment in the EU semiconductor industry.

ARTICLE | 22 PAGES